Understanding Credit Lines And Instant Personal Loans

Instant access to money can be a tremendous relief in the chaotic world of today. When you need money for a personal project, an unforeseen auto repair, or a fast investment opportunity, a credit line provides a dependable source of funds. Flexible credit solutions, which provide an instant credit boost and make life more straightforward and manageable when faced with emergency situations, are becoming popular.

What is a credit line?

One type of variable borrowing that gives you a fixed credit limit is a credit line. Rather than taking out a loan in one large amount, think of it as having a readily available pool of money that you may draw from whenever needed. Because of its adaptable nature and the fact that interest doesn’t start to collect until you actually use it, a credit line is increasingly being chosen over conventional financing.

Immediate financial independence:

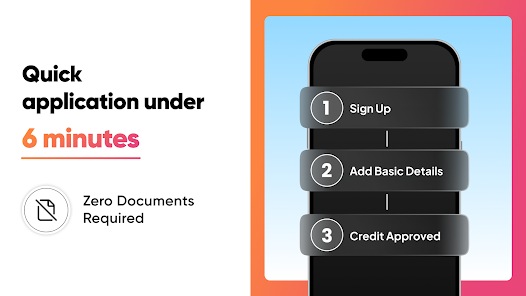

The ability to get credit right now is one of the main advantages of a credit line. You can quickly access your money using a quick credit option, which can be quite helpful in an emergency. Nowadays, a lot of credit lines provide nearly instant approvals, particularly for internet applications. You may avoid a lot of the documentation and waiting periods that come with conventional loans by applying for an instant personal loan online using a credit line.

A smaller credit limit typically qualifies for this quick approval process, which makes it perfect for routine spending or minor crises. The funds are typically available minutes after you are authorized. Additionally, you can apply online from the convenience of your own residence and receive the funds without any hassle.

How do credit limits operate?

The lender assigns you a credit limit if you are granted approval for a credit line. The most you can borrow is this sum. With a credit line, you can borrow money gradually up to the maximum, as opposed to receiving a flat sum like you would with a loan. This suggests that you only withdraw the amount you require and that charge is only charged on the amount actually spent, not your entire credit limit.

Assume you have a five thousand dollars credit limit on your credit line. You just pay interest on the one thousand dollars you borrowed, leaving you with four thousand dollars left over if you only utilize one thousand dollars. Credit lines are quite useful for meeting unforeseen expenses without taking on excessive debt because of their versatility.

Benefits of online instant personal loans:

Online solutions for rapid personal loans are equally convenient for people who prefer the format of loans. Online applications are available for instant loans to individuals, which have rapid fund transfers and approvals. This implies that you can request for a loan, get it accepted, and obtain it without ever having to visit a bank.

An instant personal loan, in contrast to a credit line, offers a fixed sum of money, which is frequently perfect for bigger purchases or anticipated costs. An online instant personal loan is a good option if you need money right away with precise conditions and a planned payback schedule.

Conclusion:

Accessing finances has never been simpler thanks to current financial solutions, whether you need an online rapid personal loan for a specific purpose, an unlimited credit limit for flexibility, or immediate financing to cover an emergency need. To avoid debt, just make sure you utilize these instruments sensibly, borrowing just the amount you need and repaying it on schedule.

Financial independence is only a click away thanks to the abundance of easy credit alternatives available! Examine your alternatives to determine which loan or line of credit best meets your needs.